Contents:

VDC has a total of 104 holdings and holds stocks from the United States that are in the MSCI US IMI 25/50 Consumer Staples index. The most popular consumer ETF on the market, XLP, follows the S&P Consumer Staples Select Sector Index. The in-focus P&G takes the first spot, making up roughly 14% of the assets. Management has raised its sales view for fiscal 2023, while it retained its earnings outlook. For fiscal 2023, the company anticipates year-over-year all-in sales growth of 1% compared with down 1% and flat stated earlier.

It seeks to track the performance of the MSCI U.S. Investable Market Consumer Staples Index, an index of stocks of large-, mid-, and small-size U.S. companies within the consumer staples sector. Vanguard Consumer Staples ETFs provide investors with access to a basket of various consumer sector stocks. The consumer discretionary sector can best be summed as “needs” rather than “wants.” This includes firms that engage in the manufacture of food, household goods and personal products. The ETFs feature all market capitalizations and focus on the domestic market. T Index/Consumer Staples 25/50, an index made up of stocks of large, mid-size, and small U.S. companies within the consumer staples sector, as classified under the GICS.

Normally $25 each - click below to receive one report FREE:

The pandemic-driven supply chain woes and the resultant red-hot inflation, the Russia-Ukraine war and the resultant hit to the commodity market as well as the central banks' policy tightening in the d... Investors can consider putting their money on non-cyclical consumer staples ETFs amid fears of an economic recession. These six sectors and related ETFs hold promise this season. To further protect the integrity of our editorial content, we keep a strict separation between our sales teams and authors to remove any pressure or influence on our analyses and research. Verify your identity, personalize the content you receive, or create and administer your account.

This exchange-traded fund from Vanguard is a quintessential index fund. That means that this ETF closely reflects the movements of the index that it tacks at all times. Vanguard Consumer Staples Index Fund ETF Shares is offered by prospectus only. Read and consider the prospectus carefully before investing in any fund to ensure the fund is appropriate for your goals and risk tolerance.

- However, the company expects EPS at the low end of the prior-mentioned range due to the ongoing commodity and material cost headwinds, and currency impacts.

- Most of us would probably do better if we avoided attempting such a difficult task.

- In addition, the company’s raised sales guidance for fiscal 2023 added to the upbeat tone.

- Our authors can publish views that we may or may not agree with, but they show their work, distinguish facts from opinions, and make sure their analysis is clear and in no way misleading or deceptive.

- Sector and region weightings are calculated using only long position holdings of the portfolio.

- Supporting their topside moves have been some of XLP’s and VDC’s overlapping holdings.

Sean is interested in the people and technologies that are improving the world. This article was updated on August 8th, 2022 to reflect the changes in performance, holdings, and other relevant characteristics of each fund. The Consumer Staples Select Sector SPDR Fund and the Vanguard Consumer Staples ETF are good consumer staples ETFs to buy if you’re seeking diversified exposure to this sector of the economy.

The portfolio maintains a cost advantage over competitors, priced within the cheapest fee quintile among peers. Investment news, stock ideas, and more, straight to your inbox. Our experts picked 7 Zacks Rank #1 Strong Buy stocks with the best chance to skyrocket within the next days.

Coke, PepsiCo Earnings Should Boost Staples ETFs

The https://1investing.in/ 500 Equal Weight Consumer Staples ETF is an equal-weighted fund that invests in the Consumer Staples sector of the S&P 500 Index. It has accumulated over $15 billion in assets since its first launching in 1998, which is more than double the next largest fund in the space. Let's check out a few safe ETF areas that investors can consider keeping in mind the rising concerns from the high inflation levels amid the war crisis. Walmart reported fourth-quarter fiscal 2023 results, wherein it surpassed both earnings and revenue estimates but issued a weaker-than-expected outlook for the full year. Dow Jones Industrial Average, S&P 500, Nasdaq, and Morningstar Index quotes are real-time. Vanguard Consumer Staples ETF’s strong process and parent firm underpin this strategy's Morningstar Medalist Rating of Gold.

5 ETFs That Gathered Maximum Capital Last Week - Zacks Investment Research

5 ETFs That Gathered Maximum Capital Last Week.

Posted: Tue, 25 Apr 2023 13:12:54 GMT [source]

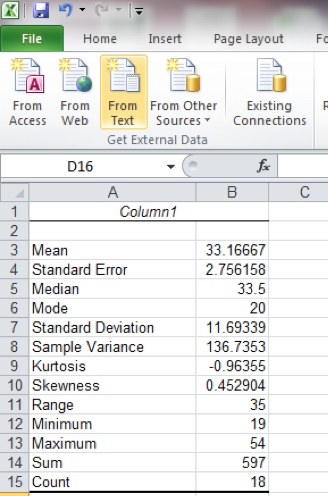

ETF Database's Financial Advisor Reports are designed as an easy handout for clients to explain the key information on a fund. The following charts reflect the allocation of VDC's underlying holdings. The following charts reflect the geographic spread of VDC's underlying holdings. RHS has the same holdings as the Consumer Staples Select Sector SPDR Fund , but instead, each holding in RHS receives a somewhat identical allocation. This ETF is for you if you’re seeking exposure to Consumer Staples stocks from around the world.

What is a good consumer staples ETF?

This may impact how, where, and in what order products appear. Opinions expressed on this site are the author’s alone, not those of a third-party entity, and have not been reviewed, approved, or otherwise endorsed. The iShares Global Consumer Staples ETF invests in global equities that produce essential products such as food, tobacco, and household items. The 33 companies in XLP conduct business in the food and staples retailing, beverage, food product, tobacco, household product, and personal product industries in the U.S.

COVID was raging and the world was full to the brim with uncertainty. If there’s one thing investors hate above all else, it is uncertainty. As such, the crash that we saw across February and March of 2020 wasn’t exactly unexpected in hindsight. Any copying, republication or redistribution of Lipper content, including by caching, framing or similar means, is expressly prohibited without the prior written consent of Lipper.

The Zacks Analyst Blog Highlights Coca-Cola, PepsiCo, XLP, FSTA and VDC

This fund manages a $6.91 billion asset base and provides exposure to a basket of 89 consumer stocks. The product charges a low fee of 10 bps per year from investors. Free Report) – gave investors sweet surprises on Apr 21, 2023 by beating the Zacks Consensus Estimate for both earnings and sales in third-quarter fiscal 2023. In addition, the company’s raised sales guidance for fiscal 2023 added to the upbeat tone.

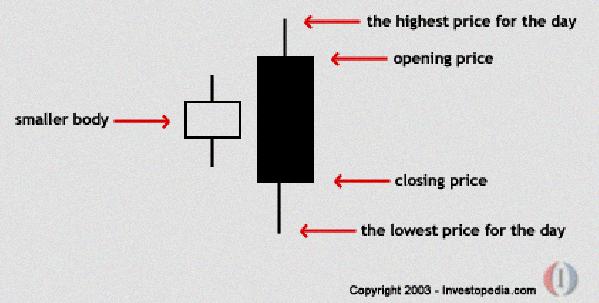

The performance data shown in tables and graphs on this page is calculated in USD of the fund/index/average , on a Bid To Bid / Nav to Nav basis, with gross dividends re-invested on ex-dividend date. Past performance is not necessarily a guide to future performance; unit prices may fall as well as rise. Intraday Data provided by FACTSET and subject to terms of use. Historical and current end-of-day data provided by FACTSET. Real-time last sale data for U.S. stock quotes reflect trades reported through Nasdaq only.

FSTA: Fidelity Consumer Staples Is Shelter-In-The-Storm ... - Seeking Alpha

FSTA: Fidelity Consumer Staples Is Shelter-In-The-Storm ....

Posted: Mon, 29 Aug 2022 07:00:00 GMT [source]

This included $2.2 billion of dividend payouts and $1.4 billion of share buybacks. It expects reported EPS to be flat to up 4% from the $5.81 reported in fiscal 2022. However, the company expects EPS at the low end of the prior-mentioned range due to the ongoing commodity and material cost headwinds, and currency impacts.

Target High-Quality Treasury Funds While Rates Go Up

Companies that produce essential goods like food, beverages, and consumer products come into favor when investors turn to value-oriented equities. VDC was launched on Jan 26, 2004 and is managed by Vanguard. But then there are also dividend distributions to consider. Like most ASX index funds, the Vanguard Australian Shares ETF pays out a distribution every quarter to investors.

Information is provided 'as is' and solely for informational purposes, not for trading purposes or advice, and is delayed. To see all exchange delays and terms of use, please see disclaimer. SimpleMoneyLyfe is an independent, advertising-supported publisher and may receive compensation for some links to products and services throughout this website.

ZacksTrade does not endorse or adopt any particular investment strategy, any analyst opinion/rating/report or any approach to evaluating indiv idual securities. Pricing for ETFs is the latest price and not "real time". Share price information may be rounded up/down and therefore not entirely accurate. FT is not responsible for any use of content by you outside its scope as stated in the FT Terms & Conditions.

The company has reported net sales of $20,068 million, up 4% year over year. Sales surpassed the Zacks Consensus Estimate of $19,295 million and our estimate of $18,824.6 million. The increase in sales can be attributed to growth across all segments. All content on FT.com is for your general information and use only and is not intended to address your particular requirements.

According to the Centers for Disease Control and Prevention, ... Upbeat what ought to petty cash funds be used for provided by Coca-Cola Company and PepsiCo earnings should boost consumer staples ETFs. The Parent Pillar is our rating of VDC’s parent organization’s priorities and whether they’re in line with investors’ interests. So between 23 March and today, this ETF has forked out nine dividend distributions, worth a collective $10.36 per unit. Since we have 85 VAS units, our investor would have also received a rough total of $880.60 in dividend income as well. That stretches our gain to $3,581.60, and our total lump sum to $8,581.60, or a gain of 71.63%.

The prospectus contains complete information on advisory fees, distribution charges, and other expenses. Recent stocks from this report have soared up to +178.7% in 3 months - this month's picks could be even better. The company returned $3.6 billion of value to its shareholders in the fiscal third quarter.

News Corp is a global, diversified media and information services company focused on creating and distributing authoritative and engaging content and other products and services. You are being directed to ZacksTrade, a division of LBMZ Securities and licensed broker-dealer. The web link between the two companies is not a solicitation or offer to invest in a particular security or type of security.

The monthly returns are then compounded to arrive at the annual return. Only Zacks Rank stocks included in Zacks hypothetical portfolios at the beginning of each month are included in the return calculations. Zacks Ranks stocks can, and often do, change throughout the month. Certain Zacks Rank stocks for which no month-end price was available, pricing information was not collected, or for certain other reasons have been excluded from these return calculations. The Fund seeks to track the performance of a benchmark index that measures the investment return of consumer staples stocks.

The figure also beat the Zacks Consensus Estimate and our estimate of $1.32. Currency-neutral core earnings per share rose 13% year over year. Sector and region weightings are calculated using only long position holdings of the portfolio. © 2023 Market data provided is at least 15-minutes delayed and hosted by Barchart Solutions.

Intraday data delayed at least 15 minutes or per exchange requirements. The Motley Fool Australia has no position in any of the stocks mentioned. Exchange traded funds focused on the Consumer Staples sector have tracked higher since the start of 2023, with some of the most prominent names in the category climbing to 4-month trading highs.