Content

Conclusively, over the course of a company’s fiscal year, the balance in the depreciation expense account increases and is then flushed out and set to zero. The balance is zeroed out as part of the year-end closing process. Then, the account is used again to store depreciation charges in the next fiscal year. When accounting for depreciation, is depreciation expense a debit or credit? In this article, we will discuss depreciation expense and its journal entry to ascertain whether depreciation expense is a debit or credit.

- To find accumulated depreciation, look at the company’s balance sheet.

- Depreciation is usually seen as a cost, even though unlike other expenses, it is not a direct cash outflow.

- Again, the customer views the credit as an increase in the customer's own money and does not see the other side of the transaction.

- David Kindness is a Certified Public Accountant and an expert in the fields of financial accounting, corporate and individual tax planning and preparation, and investing and retirement planning.

- INVESTMENT BANKING RESOURCESLearn the foundation of Investment banking, financial modeling, valuations and more.

- Simultaneously, each year, the contra asset account or accumulated depreciation will increase by $10,000.

Since fixed assets have a debit balance on the balance sheet, accumulated depreciation must have a credit balance, in order to properly offset the fixed assets. Thus, accumulated depreciation appears as a negative figure within the long-term assets section of the balance sheet, immediately below the fixed assets line item. Current liability, when money only may be owed for the current accounting period or periodical. Examples include accounts payable, salaries and wages payable, income taxes, bank overdrafts, accrued expenses, sales taxes, advance payments , debt and accrued interest on debt, customer deposits, VAT output, etc. This use of the terms can be counter-intuitive to people unfamiliar with bookkeeping concepts, who may always think of a credit as an increase and a debit as a decrease.

Accumulated Depreciation Journal Entry

Instead, accumulated depreciation is the way of recognizing depreciation over the life of the asset instead of recognizing the expense all at once. After two years, the company realizes the remaining useful life is not three years but instead six years. Under GAAP, the company does not need to retroactively adjust financial statements for changes in estimates. Instead, the company will change the amount of accumulated depreciation recognized each year. Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. Accumulated depreciation is a contra asset account, meaning its natural balance is a credit that reduces the overall asset value.

It is the simplest method because it equally distributes the depreciation expense over the life of the asset. In our PP&E roll-forward, the depreciation expense of $10 million is recognized across the entire forecast, which is five years in our illustrative model, i.e. half of the ten-year useful life. The formula for calculating the accumulated depreciation on a fixed is accumulated depreciation credit or debit asset (PP&E) is as follows. The purpose of depreciation is used to match the timing of the purchase of a fixed asset (“cash outflow”) to the economic benefits received (“cash inflow”). Accumulated depreciation is not an asset because balances stored in the account are not something that will produce economic value to the business over multiple reporting periods.

Is depreciation expense debit or credit?- Video

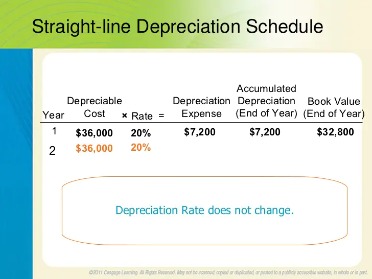

Multiple methods of accounting for depreciation exist, but the straight-line method is the most commonly used. This article covered the different methods used to calculate depreciation expense, including a detailed example of how to account for a fixed asset with straight-line depreciation expense. This is machinery purchased to manufacture products for the business to sell. Since the equipment is a tangible item the company now owns and plans to use long-term to generate income, it’s considered a fixed asset. This method first requires the business to estimate the total units of production the asset will provide over its useful life. Then a depreciation amount per unit is calculated by dividing the cost of the asset minus its salvage value over the total expected units the asset will produce.

- This can include real estate, office equipment, machinery, vehicles, furniture, and much more.

- The end result is that the asset is removed from the balance sheet.

- To demonstrate how accumulated depreciation is adjusted due to the expense of depreciation, assume that on January 1 a company purchases machinery in the amount of $8,000.

- Most companies rely heavily on the profit and loss report and review it regularly to enable strategic decision making.

- Unlike the other methods, the units of production depreciation method does not depreciate the asset based on time passed, but on the units the asset produced throughout the period.

Accumulated depreciation for the related capitalized assets is shown on the balance sheet below the line. The accumulated balance of depreciation increases over time, adding the amount of the depreciation expense recorded during the current period. Accumulated depreciation is the total amount that was depreciated for an asset up to a single point. Each period is added to the opening accumulated depreciation balance, the depreciation expense recorded in that period. The carrying value of an asset on the balance sheet is the difference between its historical cost and accrued amortization.

Accounting for Accumulated Depreciation

Again, the customer views the credit as an increase in the customer's own money and does not see the other side of the transaction. The Profit and Loss Statement is an expansion of the Retained Earnings Account. It breaks-out all the Income and expense accounts that were summarized in Retained Earnings. The Profit and Loss report is important in that it shows the detail of sales, cost of sales, expenses and ultimately the profit of the company. Most companies rely heavily on the profit and loss report and review it regularly to enable strategic decision making. Accumulated depreciation is carried on the balance sheet until the related asset is disposed of and reflects the total reduction in the value of the asset over time.

Why do we debit accumulated depreciation?

Debiting Accumulated Depreciation

We credit the accumulated depreciation account because, as time passes, the company records the depreciation expense that is accumulated in the contra-asset account.